Experts from the California School Boards Association, Children Now and the education law firm Dannis Woliver Kelley dissected the Governor’s May Revision budget proposals during a May 15 webinar, “May Revise: Prop 98 under siege.”

As expected, Gov. Gavin Newsom’s decision to double down on his proposed Proposition 98 maneuver led the discussion.

Robert Manwaring, senior policy and fiscal advisor for Children Now and former K–12 education director of the California Legislative Analyst’s Office, said to think of the maneuver like a school bond where the state has already spent the money and is going to then pay for it in future years out of the non-Prop 98 side of the budget.

“That may sound to some like a pretty good deal, because schools get to keep the $8.8 billion and the expense of it is on future non-Prop 98 side of the budget,” Manwaring said. “The problem is that $8.8 billion creates the basis for the calculation for the 2023–24 minimum guarantee, the 2024–25 guarantee and beyond.”

As proposed by the Governor, Prop 98 is projected to remain in Test 1 for the current year and foreseeable outyears. The May Revise reduces the Proposition 98 Guarantee by $3.5 billion, which is below what was estimated in the Governor’s January Budget Proposal. Due to the drop in the guarantee, the Governor proposes to increase the amount of money being withdrawn from the Prop 98 Reserve by approximately $2.7 billion over the three-year period of 2023–24, 2024–25 and 2025–26 from $5.7 billion to $8.4 billion. This would exhaust the entirety of the reserve and effectively lift the local reserve cap requirement for the 2024–25 school year. Essentially, if adopted, the state would fund paying a prior-year debt — a now estimated $8.8 billion gap in Prop 98 funding in the prior 2022–23 fiscal year — using its own cash balance.

CSBA is urging the Legislature to reject the maneuver on the grounds that it would undermine the spirit of Prop 98, as well as its statutory and constitutional requirements. The concern is that the proposal would set a worrisome precedent, which if adopted, could be used by future governors and Legislatures to avoid complying with the Prop 98 funding guarantee. (Read CSBA President Albert Gonzalez’s statement on the May Revise)

“From CSBA’s perspective, ensuring that the guarantee remains the guarantee is critically imperative,” said CSBA Legislative Director Chris Reefe. “CSBA has always been a leader in protecting Prop 98 and will continue to protect Prop 98 to ensure that schools and the students that they serve continue to receive the funding they need to be able to provide for the academic and social and emotional outcomes for children. What the Governor’s proposing is more short term — I would say short-term gain for long-term pain when we’re saying there’s a potential here where we might have to argue and advocate for short-term pain for long-term gain.”

The Governor’s maneuver poses not only a threat to Prop 98 from a policy perspective, but also from a legal perspective, explained William Tunick, shareholder and chair of the Dannis Woliver Kelley’s Board Ethics, Transparency and Accountability and Litigation Practice groups.

“Prop 98 creates a constitutional guaranteed level of funding for education, but it doesn’t actually establish what that amount is in numerical terms. Instead, what it does is it establishes three tests that are used annually to determine what that guaranteed level is,” Tunick said. “And because of that, and this is what the courts have said, the integrity of those tests are really fundamental to Prop 98 itself. What the maneuver does or attempts to do is alter how those tests work by altering the inputs. If you artificially alter the amount of allocations in a prior year, that’s going to then artificially lower those tests and the amounts that those tests give you when you run the Prop 98 calculations.”

The importance of advocacy

Because Newsom’s revised state budget deficit was estimated to be $7 billion larger than projected in the January Budget Proposal, a significant number of new changes were proposed — though not all updates were negative on their face. As always, the devil is in the details.

For instance, consistent with CSBA’s priority to fund existing programs, the May Revise does continue funding for significant programs established or expanded during the pandemic, including universal transitional kindergarten (although in prior year budgets, $550 million in facilities funding for the Preschool, Transitional Kindergarten and Full-Day Kindergarten Program was delayed until the next fiscal year) home-to-school transportation, the Community Schools Grant Program and teacher recruitment and development programs.

However, CSBA Chief of Governmental Relations Patrick O’Donnell noted that if the Legislature adopts the Governor’s maneuver, it would be difficult to maintain these programs going forward. That’s where school board member advocacy becomes vital.

“Don’t agonize, organize. The question is ‘what can locals do?’ The answer is a lot. You are going to have the impact,” O’Donnell said, urging trustees to sign up for CSBA’s advocacy text alerts (text CSBA4kids to 52886 to join), develop and adopt brief advocacy plans, set up meetings with local state representatives and more.

“Don’t just sit off to the side. You are part of the solution. You are your own best advocates,” he continued. “If you need any further messaging, any more information, feel free to reach out to our Governmental Relations team here at CSBA. That’s what we’re here for. And we want to help you be successful in your meeting because if you’re successful in your meeting, that means the Legislature wakes up and rejects this budget proposal.”

A recording of the webinar is available here | Presentation slides are available here

Other key budget proposal components

Cost-of-living adjustment (COLA)

The COLA is proposed to increase from 0.76 percent to 1.07 percent for 2024–25, and would apply to all programs that have historically received an adjustment. These include special education, state preschool, the mandates block grant and more.

Local Control Funding Formula (LCFF)

The LCFF is projected to be reduced by $1 billion in one-time funding and another $300 million in ongoing Prop 98 funding, for a total $1.3 billion reduction in 2024–25. According to the Department of Finance, this is due primarily to impacts of declining enrollment, but it is buttressed by increased transitional kindergarten enrollment and slight increases in attendance since the pandemic.

Per-pupil funding in the May Revise is down $151 when compared to the January proposal, from $17,653 to $17,502. However, when all funds are taken into account, including federal funds, non-Prop 98 moneys, grant funds and funding not available to all LEAs, per-pupil funding is up from a proposed $23,519 in the January Budget Proposal to $23,940 in the May Revise — a difference of $421 per pupil.

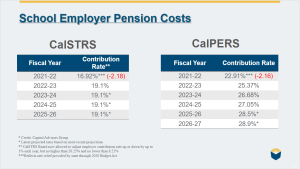

Pensions

The 2021–22 fiscal year was the last time that the state stepped forward to help offset some of those costs that LEAs are incurring as a result of the unfunded liability by buying down a little bit more than 2 percent of the employer contribution rate, explained CSBA Legislative Advocate Carlos Machado.

CalPERS recently released the employer contribution rate for 2024–25 (27.05 percent). “That’s a little lower than what was projected earlier, but it’s still more than what we’re seeing in the current fiscal year,” Machado said. “There is no support that is proposed in the budget to help offset these costs for LEAs this year. I think we can reasonably expect that we won’t see anything in the near future given the situation with the budget, but this is something that obviously LEAs should consider as they’re planning their budgets and looking at outyears when we see these increases, particularly on CalPERS’ side where we’re seeing increases year after year. CalSTRS has been relatively confident at this point that they can cover their costs with a rate of 19.1 percent going forward.”

Special education

The revise proposes an increase of approximately $134 million in ongoing Prop 98 funding for special education. This includes an increase of just over $117 million for growth in average daily attendance and about $19.6 million for a 1.07 percent COLA.

Universal school meals

To reflect a revised estimate of total meals served in the current year, the May Revise includes a proposed increase in the allocation of Federal Child Nutrition Program funding of about $120 million for a total of $298.3 million, where approximately $179.4 million is ongoing. The Universal School Meals program is also proposed to receive a COLA, resulting in an increase of $19.54 million.

Electric school buses

The Governor proposes to increase funding for electric school buses from $500 million to approximately $895 million. The $395 million addition will be funded with $145 million in Proposition 98 funds and by transferring $254 million from funds that would have increased inclusionary services for special needs students in the California State Preschool Program.

School facilities

The proposal would increase the reduction of the School Facilities Aid Program by an additional $375 million for a total reduction of $875 million over the two-year fiscal period of 2023–24 and 2024–25. Additionally, rather than once again delaying the $550 million in prior year budgets for the Preschool, Transitional Kindergarten and Full-Day Kindergarten Program, the May Revise proposes to eliminate the funding.

Broadband Infrastructure Grant Program

The program, established in 2019 to provide broadband connectivity over a five-year period, was extended in the 2023 Budget Act for an additional four years. However, the May Revise proposes deleting the extension, effectively eliminating the program June 30, 2024.

Changes to attendance recovery and instructional continuity proposals

In the January Budget, the Governor proposed a number of policy changes to “allow LEAs to provide attendance recovery opportunities to students to make up lost instructional time, thereby offsetting student absences, and mitigating learning loss and chronic absenteeism, as well as related fiscal impacts.”

The Governor proposes delaying the implementation of the attendance recovery program until July 1, 2025, and making other clarifying changes to program implementation. This would include permitting Saturday and Sunday attendance programs to count for reporting chronic absenteeism and clarifying the conditions of participation in instructional continuity programs lasting beyond 15 days.

Educational Revenue Augmentation Fund (ERAF)

The May Revise maintains the Governor’s January proposal to include charter schools within the existing ERAF calculation statutes. Implemented by statute in 1992, it shifts from the state’s general fund to local property taxpayers some of the obligation to meet the constitutional minimum funding guarantee in Proposition 98. The ERAF has historically redirected property taxes statewide from cities, counties and special districts to school districts and community college districts. This change would ensure that, for purposes of the ERAF calculation, charter schools are included.

Expanded Learning Opportunities Program (ELO-P)

The May Revise proposes to maintain the Governor’s ongoing prioritization of ELO-P, but makes some technical changes to clarify that encumbered 2021–22 and 2022–23 funds must be spent by Sept. 30, 2024, requires ELO-P moneys be spent within two years and requires LEAs to declare their intent to offer ELO-P programs beginning in 2025–26. It would also allow for the reallocation of unspent funds.

SB 291 pupil recess cleanup

The revise proposes changes to Senate Bill 291 (Chapter 863, Statutes of 2023) to clarify that recess requirements do not apply to students enrolled in the sixth grade, unless the student does not receive physical education instruction.

Equity Multiplier funding clarifications

The revise clarifies that the COLA applies to the Equity Multiplier for the base funding formula for schools and funds cannot be appropriated to schools that have closed.

What’s next?

The Legislature will hold hearings to review the Governor’s May Revise. The Legislature has until June 15 to adopt a budget bill, and the Governor will then have until June 30 to sign it.

CSBA will continue to monitor the implications of the May Revise and provide opportunities for advocacy. The organization is also co-sponsoring a series of in-person Budget Perspectives Workshops in partnership with Capitol Advisors that will focus on a detailed breakdown of the May Revise. Workshops will be held at county offices of education across the state from May 22–June 5. Register here.